Congrats 🎉 , you’re here! And that must mean you’re ready to get serious about saving (and investing) your money. Maybe you just started your v first job or finally have a 401K. If so, you’ve come to the right place.

I know it may seem like retirement is a long way off, which is great because that means time is on your side. However as a woman striving for Financial Independence, I believe it’s so important to have work be optional if (more like when) your passions in life change. Although you may love your job today, ultimately you should have the financial ability to walk away and pivot your life to do whatever you want to do with it.

Maybe you want to be a stay at home mom or change careers or perhaps just travel more. You shouldn’t have to depend 💯% on your paycheck or partner to be able to do that. THAT is what investing and saving is for!

Here is the order of priority in which you should start saving your money on your journey to Financial FREEDOM:

Emergency Fund (3-6 months or 1 month if you have debt)

Employee 401K Match (if applicable)

Pay off debts

Max 401K (if applicable)

Max IRA

Go ham on taxable brokerage accounts

*Note: All of the numbers below reflect those who are SINGLE filers and under 55.

1. Open a high yield savings account (HYSA) & save 3-6 months of money

The absolute first thing I recommend you do if your current savings are at a Big Bank 🏦 , i.e. Bank of America, Chase, Wells Fargo, etc. is move that cash to an HYSA that earns ~1-2% of interest depending on the economy. Versus at Big Banks, you usually only get a 0.1% interest per month so you are losing A TON of money to inflation. While HYSA accounts don’t keep up with the yearly inflation rate, you at least lose less!

Right now I make about $20+ per month of interest on my Emergency 🚨 account that I have with Wealthfront. Love their simple UI, it’s so easy to use. Here’s my link to sign up for one too. Don’t walk, RUN. It takes less than 10 minutes to sign up and that interest money will make you feel like a million bucks! Seriously come back, I’ll wait.

Okay so now that you’ve opened your account, you’ll want to save 3-6 months of expenses in there justttt in case anything happens. I air on the side of caution since I don’t always have a steady income, so I have 6 months’ worth of savings in mine.

If you’re a full time employee 3 months is probably good, and if you have any debt, just start with one month. The key 🔑 to getting out of debt is not accruing more, which is why it’s important to have a little padding.

2. Max employee-sponsored 401K match (if applicable)

If your employer contributes a percentage of your paycheck to your 401K, take it. That is literally FREE money they are giving you. For example if they match up to 4%, 1$ on the first 3% and 0.5% on the rest up to 4%, you’d need to contribute at least 6% of your paycheck to get that full match.

If like me, you don’t get employer contributions, continue right along.

3. Pay off debts

If you don’t have debt, go right into investing with step 4.

The only way you’ll get out of debt is to stop spending more than you earn. Tackle your highest interest debts first and work your way toward the smallest. (This is known in the Debt Free Community as the Avalanche method. There is also the Snowball ❄️ method, which is to pay off your smallest dollar amount debt first since you get a psychological high, but the numbers aren’t logical so if you can stomach it, I’d go with highest interest first) Make automatic consistent payments until it’s gone. Get a bonus? Throw it at your debt. Side hustle income? Make a debt payment.

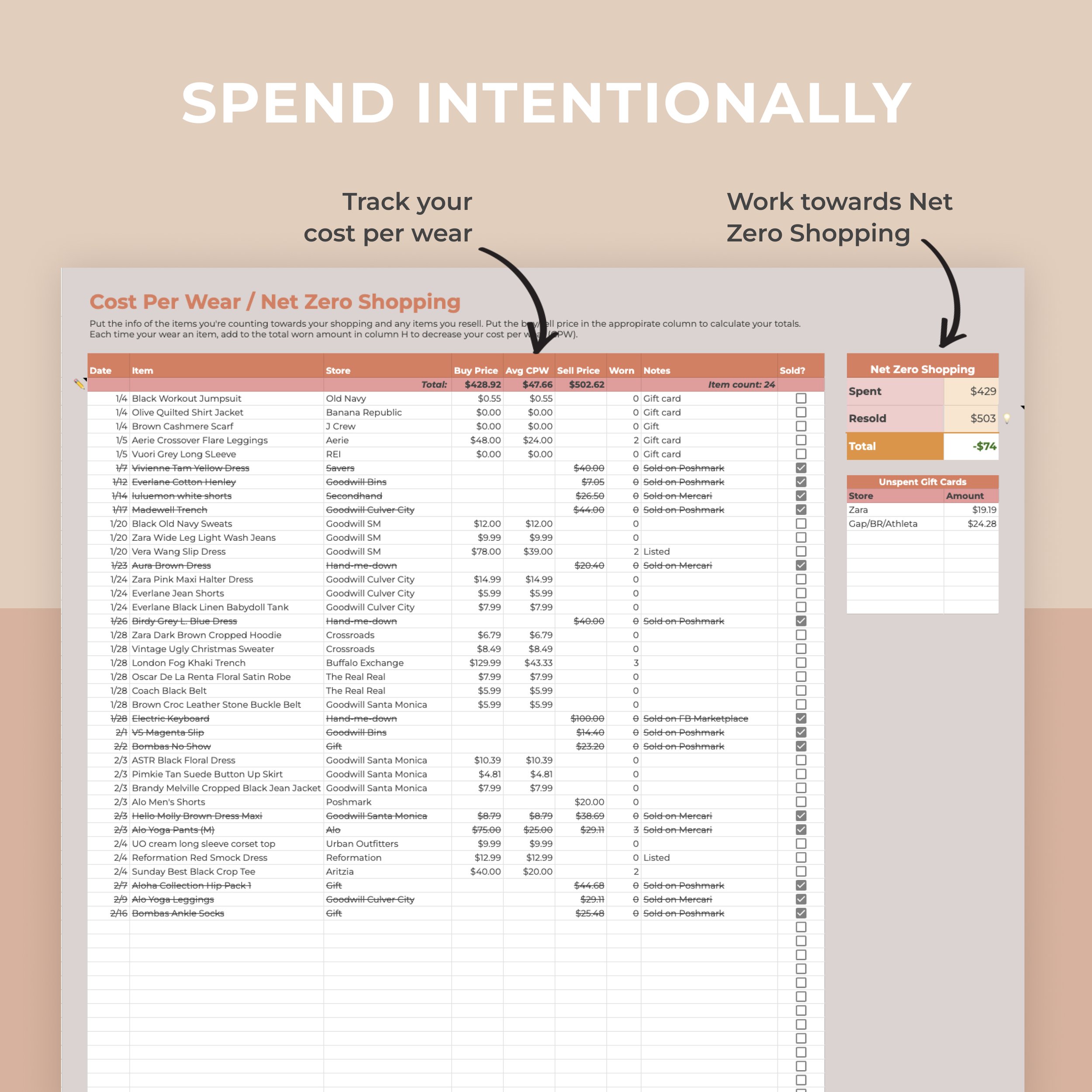

To see where you can cut back on and to get a high level overview of your expenses, track your spending for 3 solid months. And that I mean EVERYTHING. Even a $2.00 parking meter.

Here’s my personal Google Sheet that I use to track everything. Make a copy to use. To input your own categories, select the entire column (C, F, or J) and go to Data > Data Validation and retype in all the categories you think you’ll need. Update the categories in column M to match whatever you put.

I’m very spreadsheet illiterate, so if I can do it, you can do it. As you need more months, duplicate the sheets along the bottom. If you can see you’re spending $600+ on food, see how you do cutting back to $500. YOU HAVE FOOD 🍽 AT HOME! Every time you overspend you’re stealing money from your future self.

Until your debts have interest rates lower than 7%, I wouldn’t consider investing because the market return averages about that amount over 5-10 years.

4. Max your 401K ($19,500)

If you don’t have a 401K at all, move on to the next step.

I don’t expect everyone to be able to do this, especially if it’s your first job, but if you’re more than comfortable with the paycheck you’re getting after you’ve already hit the max, increase it by 1% every payday and see if you even notice it. Take advantage of your tax-advantaged accounts! They are there to help you and let your money grow in your bank accounts.

5. Max your IRA ($6,000)

Even if you don’t have access to a 401K we all have access to IRAs, which are also majorly tax-advantage. The limit is a lot less, but it’s still a lot and worth contributing to. I opened one with Charles Schwab since that’s what my dad opened my custodial account in when I was a baby. 👶 Vanguard is also a classic choice.

You commonly hear that it’s best for young adults to be invest in a Roth IRA, but this year I’ve started investing in a Traditional IRA because I’m planning on "retiring” early and living very modestly, so I assume my yearly income will dip to something very small, and therefore I’ll be paying less taxes then.

Read the Mad FIentist’s article 🧪 for the nitty-gritty details. He also has a lot of Financial Independence/Retire Early (FIRE) tips like front-loading and Roth conversion ladders that are very helpful once you’re well-versed in the basics of FIRE.

Obviously it is up to you to decide what is best for you though!

6. Go WILD on your taxable brokerage accounts

The sky’s the limit here 🌌 , aka you can invest as much as you want in your brokerage account. I have one with a robo-advisor, Wealthfront AND another with Charles Schwab, where I pick my own investments myself.

When I first started investing—and you need to start investing— I went with a robo-advisor 🤖 because it automatically picks low cost index funds (aka a balanced group of stocks) for you. Plus it automatically balances everything yourself. It’s SO easy and hands off. If you’re scared about picking your own stocks (and by stocks I really mean index funds and ETFs), I can’t recommend a robo-advisor enough. Get $5K managed free if you use my Wealthfront link to sign up. If you couldn’t tell, I LOVE WEALTHFRONT!

Once you’re ready to take the training wheels off, open an account with a big investment firm (Charles Schwab, Vanguard, Fidelity). If you’re considering Schwab, my link gets you a FREE $100 when you invest $1,000 with them. I’ve started investing more in a Target Date Index Funds because that is essentially like an EVEN CHEAPER robo-advisor.

On that note, if any of the concepts or terms above went over your head, GOOGLE IT! 👨💻 That’s how I learned everything I’m preaching. Use Investopedia, The Balance, Nerdwallet, or whatever other resource until you feel comfortable and knowledgable 🧠 about what you’re doing.

At the same time, don’t let your fear of investing or “losing” money stop you from getting started right now. You are young and time is your greatest asset. In the 150 years that the stock market has been around, there have been ups and downs, but it has always trended up. 🎢 You wouldn’t get off a roller coaster in the middle of a drop, and neither should you sell your investments at a low.

And finally, to preach Jeremy of Personal Finance Club: ALWAYS live below your means and invest early and often.

YOU CAN DO THIS!

xo, Catie