Index Funds Explained! The Easiest Way to Start Investing

/Investing can be really intimidating. There's so many complicated terms—options trading, market limit, day limit—things that make investing seem really hard and honestly, exclusionary for most people. I know I felt that way when I first started investing. I had no idea where to start. I was so confused about what to do. I'm here today to talk to you all about how I actually started investing and talk about the easiest way for anybody to start their investing journey.

Welcome back to Millennial Money Honey where we talk about all things financial independence, I share my journey to retire early, and give you all the money saving hacks. If you like this content be sure to like this video, subscribe to my channel or to the podcast, and let's talk money honey.

I started investing about three years ago and prior to that my dad had set up a custodial brokerage account when I was born. When I gained access to it, his advice to me was just choose stocks that sound good and invest in companies you actually use. For me that was so ambiguous. What if I chose the wrong company?

I was too scared to actually pull the trigger and start investing because I didn't know what to do. Because of that, I basically did nothing for the first few years that I actually gained control of this custodial brokerage account. I love my dad so much. I am so thankful that he even opened this custodial brokerage, but it wasn't enough to actually get me to start my own investing journey.

I finally saved enough money after working long enough. Plus I did a no-spend year. I decided I needed to learn what to do to invest. So I did what any average millennial does, I Googled it. From my research I decided that I wanted to invest in index funds.

What is an index fund?

Even that term in itself sounds kind of complicated. If you think of an individual stock as a single flower, think of an index fund as a bouquet of flowers. Instead of owning one individual stock you would own the entire stock market made up of a bunch of individual stocks. An index fund is so much easier because you're not choosing individual stocks. You're buying, for example, a total U.S. stock market fund like VTSAX, SWTSX, or FSKAX. All of those are total U.S. stock market funds. They are all great, they are just through different brokerages, which leads me to my next point.

What is a brokerage?

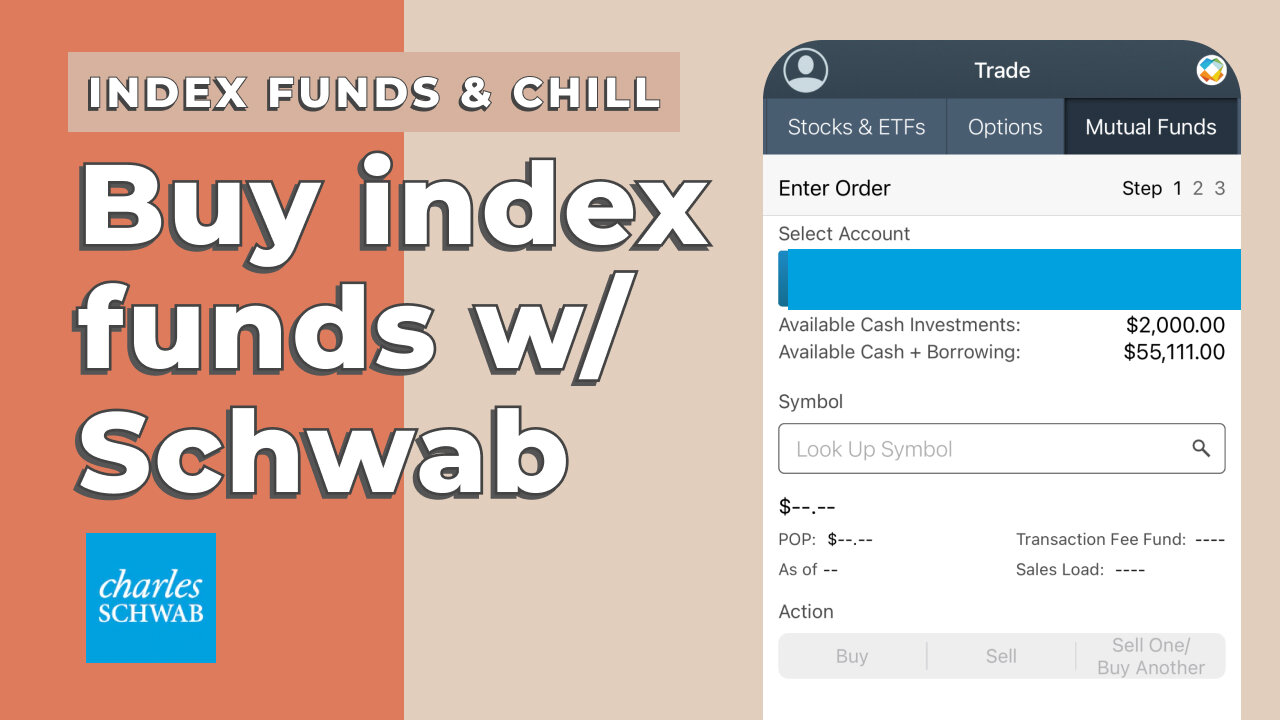

A brokerage is just a place or a financial institution in which you can purchase, buy/sell, trade stocks. My favorite three that I always recommend are Vanguard, which was founded by the founder of index funds, the guy who literally came up with the idea and made it a thing, John Bogle, Fidelity and Charles Schwab. Now they all have great index funds that they run and manage and they are all good brokerages. I personally use Charles Schwab and I love and recommend them.

The reason you would want to invest in an index fund over an individual stock is just because an individual stock can go up and down and is really subject to how well the company is doing. Versus an index fund, since it's made up of a ton of individual stocks, if something falls off of the index if it goes down to zero the stock goes away and is replaced. It is a self-cleansing, self-replenishing fund. That's why it's a little bit more safe to hold that. (As with anything financial related though do your own research. I cannot give investing advice. You need to consult a CFA or CFP.)

Level 1: Robo-advisors

After doing my research and deciding I wanted to invest in index funds, I knew it wasn't worth it for me to pay an actual person to manage my investments. This is where a robo advisor came into play. I use the robo advisor Wealthfront and I 100% recommend a robo advisor for anybody who is just getting started. If it's a matter of doing nothing and waiting until you learn more, or starting with a robo advisor, robo advisors are great.

What you do with a robo advisor is you take a quiz and basically you tell them your age, when you're planning on retiring, and your risk tolerance, which is just how nervous do you get if the stock market suddenly takes a plunge. Would you pull out all of your investments or would you stay the course? A robo advisor would advise you based on that and buy the funds based on what you've told them. It would be a mix of U.S. stocks, international stocks, bonds, and a couple of other indexes. All of your investments would be well-balanced.

Not only do they invest everything for you based on that, they rebalance if things get out of whack. If you have too much U.S. stocks they'll sell it and rebalance it and keep a healthy portfolio.

I love Wealthfront specifically because they have awesome financial planning features. You can input when and where you want to buy a house, how many kids you want, if you plan on paying for the college, if you plan on taking time off to travel, and if you want to retire early you can tell them that too. It will tell you based on that information you give it what you need to be saving for all of your financial goals.

Here is my to sign up for Wealthfront and you will get $5,000 managed for free and I will too if you use my link! I can't recommend them enough for anybody who is too scared to start investing. A robo advisor is how I got started.

Level 2: Target Date Funds

The next level up from robo advisors is target date funds. Target date funds are index funds, which also have a bunch of index funds inside of them—stocks and bonds, etc. You pick a target date index fund based on the year you turn 65 generally. I am in the target date 2055 index fund. They go in increments of five years usually, so pick the year closest to when you would turn 65.

You can get a target date fund through any different brokerage—Schwab, Fidelity or vanguard. They all have target date funds and what I like about target dates funds is they automatically rebalance and move away from stocks closer to bonds the older you get. It automatically rebalances everything for you as you reach your retirement date.

Not only that, they tend to be extremely low cost. What you want to look at is the expense ratio on your index funds. For target date funds they usually cost around 0.05% to 0.08% to manage it. What's nice about that is you just pick one fund, dump your money in and never think about it again.

Robo advisors on the other hand, not only do you have to pay the expense ratio on funds, but usually you pay a very, very small advisory fee. This shouldn't be any more than two 0.25%, which is well below what you would pay an actual person, which is anywhere from 1% to I've even heard of people paying 3% for their financial advisors. Basically what you do not want to do is pay fees because fees are lost money for you. Be sure and check expense ratios on funds!

I would, for example, look up SWYJX. That is the target date fund I invest in. I can see the expense ratio on it is 0.08%. Target date funds are great once you feel comfortable choosing your own brokerage and learning the interface of the brokerage itself.

What I like about robo advisors is their interfaces are so beautifully designed and so easy to use. Generally for Schwab, Fidelity, and Vanguard, their interfaces are a little more clunky and not user friendly. It is a bit more intimidating to use, which is why I put it at level 2.

Level 3: DIY Index Fund Rebalancing (Boglehead 3-fund portfolio)

Level 3, once you've figured out which discount brokerage you like using, is to pick index funds and rebalance them yourself. One of the most common methods of doing index fund investing is called the Boglehead 3-fund portfolio. This idea is founded by John Bogle, again the founder of Vanguard and index funds. Basically what you do is pick a percentage of indexes—so you will have a total U.S. stock market index fund, a total international stock index fund, and a total bond market index fund. You choose an allocation that you feel comfortable with.

Obviously stocks are more risky, but if you are younger you're going to have the time to be more risky. You'll be a little bit heavier in stocks and as you move closer to retirement you want to move the stocks closer to a bond fund.

I currently have my allocation at 80% U.S. stocks, 15% international stocks and 5% bonds. That's what I feel comfortable with. I'm definitely a more aggressive investor and I feel comfortable with those amounts given my current age and the length of time I am going to keep these funds in the market.

Some people rebalance their portfolio quarterly or half yearly. Rebalancing is when you would sell some assets to put it in the right percentage balance. So if you're too heavy in bonds you would sell some to buy stocks, thus putting it in balance. Since I'm still actively buying funds on a very regular basis because I still have income and am not retired yet, I like to put in money as soon as I get it.

When a paycheck hits I invest right away and I use my rebalancing calculator spreadsheet to decide where to allocate that money. It updates with numbers directly pulled from google finance so it's somewhat, but not exactly real time. It tells me if I have $1,000 to invest, where should I put that money to keep it in the right balance. This means since I rebalance my portfolio by paycheck I don't need to rebalance quarterly or even half yearly.

Since I'm with Schwab my three fund portfolio is made up of three indexes: SWTSX, Schwab's total U.S. stock market index fund, SWAGX, Schwab's total bond market index fund, and SWISX, Schwab's total international stock market fund.

I started at level one with a robo advisor and progressed to a target date fund and only as of last year I am now DIY rebalancing my index fund portfolio myself. It took a couple of years to level up to that place. If you're scared to start, I highly recommend considering just going for it. You learn from your mistakes and you can always keep leveling up as you learn and grow.

The most important thing is time in the market because the longer you're in the market, the longer your money has to compound and grow and work for you. This way you can take advantage of retiring early or becoming work optional and achieving financial independence. Don't sleep on it!

All three of these methods, robo advisor, target date funds, and the Boglehead 3-fund portfolio, are great options. Just pick one and don't wait. Let me know in the comments below what level you're on and what your ultimate goal is for leveling up your index fund investing game.

If you're a novice investor, don't let investing intimidate you! I am here to help you and guide you as much as possible. (Again do your own research though because I don’t want to be sued by the SEC.) I hope this helped you! Be sure to give it a thumbs up, subscribe to my channel or podcast, and tune in next week where we'll talk more money, honey!

Disclosure: Some links are affiliate links, meaning, at no additional cost to you, I may earn some compensation. All opinions are 100% my own! I truly appreciate you and your support. :)

![[Closed] *GIVEAWAY!* Millennial Money Honey Shop is open!](https://images.squarespace-cdn.com/content/v1/5d75d967a6cf7c535dd64803/1599244949238-5UKEL2UONTDWGSKWK01S/Mockup8.jpg)