4 Books You NEED to Read to RETIRE EARLY and FIRE

/Many people have asked me where to begin on their own journey to retiring early. For me, it all began with a book and that's why it's the starting point that I recommend to other people.

Books are perfect because you don't need to buy books at all. You can check them out from your local library, like I did, but if you're also like me, you may end up liking them after you read them and want them for your own personal reference. You might like it so much you end up buying it.

These four books are the absolute must reads to really launch your personal finance journey and I say these in this specific order to help you get started.

1. Rich Dad, Poor Dad by Robert Kiyosaki

The first book is Rich Dad, Poor Dad by Robert Kiyosaki. This book is so important to me because I think the first step to actually getting on your personal finance journey and becoming financially independent is to be in the right mindset—to think that yes, you can do it and that money should be working for you. Rich Dad, Poor Dad opens your mind to thinking like a rich person.

Even if you aren't rich, even if you're in debt, it's the mindset that will make this all a reality. You have to think rich to get rich. My favorite quote of the book was,

“Don't work for money, make your money work for you.”

This book is so eye-opening to being in control of finances and adding assets, which are things that make you money, versus having liabilities, which are things that lose value—like a car, and this is a hot take, but if you own a home and you're paying the mortgage on it not house hacking or buying as an investment property to rent out, a house is a liability. And yes, the housing market may be appreciating, but a lot of the time I think your money would be better off being invested in the stock market.

A primary residence is oftentimes a liability and I'm not saying you shouldn't buy a house, not at all, or if you own a house I’m not judging. I will one day buy a house too, but The New York Times has this really great calculator on this. Just Google “New York Times should I rent or should I buy,” and it will spit out the information based on your area and current situation. That's my hot take and if you don't believe me you should definitely read Rich Dad, Poor Dad.

2. I Will Teach You to Be Rich by Ramit Sethi

Once you've shifted your mindset to a millionaire mindset after reading Rich Dad, Poor Dad, it's time to build your house of wealth and that requires a solid foundation. So this next book is I Will Teach You to be Rich by Ramit Sethi. It's a no-BS crash course on finance 101. It touches on everything from negotiating bills, gives you an overview of credit cards, and automating all of your finances so you don't even really have to think about anything. Ramit is really funny, actionable, and most importantly I love that he doesn't encourage you to live like a pauper, but he wants you to design your own version of a rich life.

So if you like eating sushi, buying designer purses, go for it. It's just a matter of not wasting money on things you don't absolutely love. So for example, I still love traveling. I eat at bougie brunches with my friends. We go out and I don't even think twice about dropping money on things like that.

I used to have a lot of “hobbies,” that I would spend a lot of money on like clothes and fashion. I realized I don't really care about keeping up with the latest fashions or dropping $90 to get my eyelash extensions done every other week. It was a headache and didn't like spark joy—not to like Mari Kondo your life. Giving up all these beauty routines save me so much money.

Something that Ramit preaches is,

“Spend extravagantly on the things you love and cut costs mercilessly on the things that you don't.”

I actually bought this book for two of my younger sisters who just started working this year and one loved it so much she literally bought 12 copies to give to her friends as graduation presents. If that doesn't emphasize how much of a game changer this book is, I don't know what will. Definitely go check out I Will Teach You to be Rich by Ramit Sethi.

3. The Simple Path to Wealth by JL Collins

Once you've read that and built that solid understanding of personal finance, it is time for you to read The Simple Path to Wealth by JL Collins. You can save all the money you want, but unless you actually start investing your money, as Rich Dad, Poor Dad would say, your money is not working for you. JL Collins gives you the step-by-step breakdown on how to invest your money in a way that is legit so simple—like The Simple Path to Wealth makes it really so simple.

The TL;DR is you should mostly be investing in low-cost index funds, specifically a total U.S. stock market and a total bond market index fund. He preaches about VTSAX but any is good. The total U.S. stock market index fund is a group of stocks or a group of bonds. Instead of owning, for example Apple (APPL) or Tesla (TSLA) or Amazon (AMZN), you are owning a little bit of basically every single stock in the entire U.S. stock market. So if one company goes bankrupt, it gets replaced. It is self-cleansing, so it's awesome.

My favorite quote of this book was,

“I may have not owned a Mercedes, but I owned my freedom—the freedom to choose when to leave a job and freedom from worry when the choice wasn't mine.”

You must be investing to have what JL Collins calls F.U. money, which is basically just the concept of financial independence and financial freedom. You want to be able to walk away from your job tell your boss F.U. and never, ever have to go back to work again. (I don't recommend doing that because that's not very nice, but you could.) The way to do that is through investing.

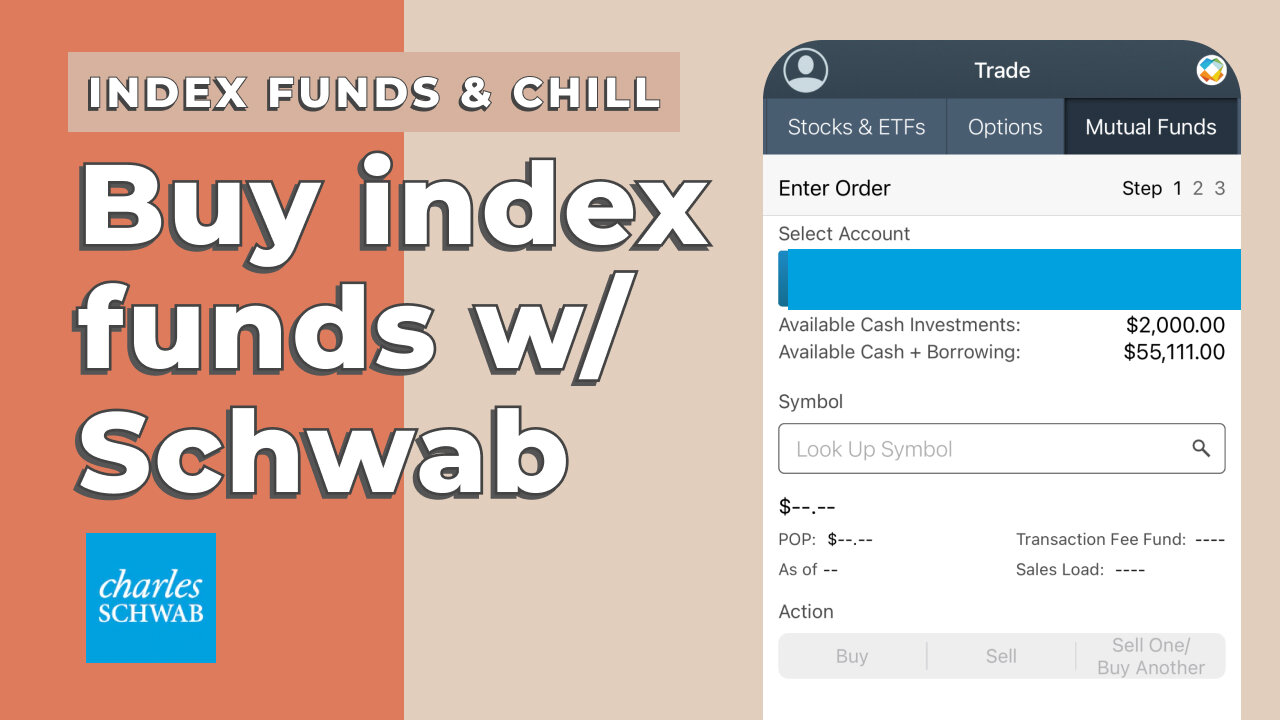

I've used Wealthfront to do my index fund investing for years which is a robo-advisor that automatically invests in index funds for you. If you're still scared and figuring it out, I 100% recommend using a robo-advisor like Wealthfront to get started investing in the meantime while you figure it out. Again this is totally not sponsored at all, I just really freaking love it. (I mean I would be down to be sponsored—shout out Wealthfront) Their app is legitimately amazing, it's so easy to use.

A lot of these big bank brokerage apps are not user friendly but Wealthfront is. After reading The Simple Path to Wealth, I decided I could manage my investments myself. If you have the ability and the funds to invest right now, but you're too afraid to manage it like I was two years ago, Wealthfront is 500% the way to go. Again, not a plug.

4. Quit Like a Millionaire by Kristy Shen

The final book on my list is a book on how to actually become financially independent and then retire early. It's called Quit Like a Millionaire by Kristy Shen. I love this book for several reasons, the first one being Kristy is a woman in the super male dominated FI world.

She also makes conservative financial estimates like me. I'm scared of not having enough. She also shows you these US-based tax hacks on how to actually minimize your taxes. Once you reach your financial independence number she gives you a detailed breakdown on what to do when you actually cross over to FI.

So this is a must read for anybody pursuing financial independence and wanting to retire early. Her belief aligns 100% with mine in that, no matter your circumstances, wherever you come from, whatever your background is, everyone can retire early. Financial independence is literally for everyone, as her title implies, no trust funds, luck, or gimmicks required.

Kristy herself grew up impoverished in China and yet she still managed to retire at 31. She is a girl goal inspiration. My favorite quote of hers from this book is,

“If you understand money, life is incredibly easy and if you don't understand money, which the vast majority don't, life is incredibly hard.”

I 100% believe that and that's why I feel like it's so important for you to educate yourself, to read books like Quit Like a Millionaire, to watch these Youtube videos, in order to really teach yourself more about money.

I've read a lot of other personal finance books like Your Money or Your Life by Vicki Robbins, Work Optional, Playing with FIRE, and many more, but these are the four books I always come back to and the ones that stood out from the vast library of books that I've read. Whether you're just beginning your finance journey or you're already on the path to financial independence, these are the four books that you have to read.

Honestly these books are so helpful and go to show that FI/RE is for everyone who's willing to put in the work to learn and teach themselves more. So if you're looking for something to do this quarantine, seriously who isn't, these books are a great way to start your journey into the world of finance.

So if you found this helpful for your own FIRE journey, like the video above, subscribe to my channel. And let me know in the comments what other books that have inspired you! Be back next week so we can talk more money honey.

Disclosure: Some links are affiliate links, meaning, at no additional cost to you, I may earn some compensation. All opinions are 100% my own! I truly appreciate you and your support. :)

![[Closed] *GIVEAWAY!* Millennial Money Honey Shop is open!](https://images.squarespace-cdn.com/content/v1/5d75d967a6cf7c535dd64803/1599244949238-5UKEL2UONTDWGSKWK01S/Mockup8.jpg)