What I Spent In February 2021

/I wanted to give you a peek inside my actual spending. I love looking at other people’s budgets, but I've always felt I can't do that because if you haven't seen my article yet, I do not budget.

Instead, I’m very precise about tracking all of my cash flow. I don't have actual dollar amounts that I allocate to categories or give every dollar a job like many others usually do. So I’m testing out showing you what I spent in a month and all of the totals, instead of doing a budget with me at the beginning of the month.

We’ll see how this goes…

Income

Let's dive a little bit deeper into my actual February numbers.

💰 Paycheck: $7061.76

This is my regular nine to five job. I work as a visual designer in tech making over six figures. It was a long, long journey to make six figures. I've been working for eight years now and you can check out my salary timeline to see how much I earned straight out of college. I’ve negotiated my way up, up, up. I take home about $7,000 a month.

This month is a little bit weird and it will be weird into March because I'm front loading my 401k. I’m putting 75% of each paycheck towards contributing the maximum $19,500 you can put in a 401k. I personally prefer to spend more time in the market rather than timing the market or dollar cost averaging. Personal finance is personal and this is how I’m doing it.

Note: Check with your HR benefits specialists to understand how they match your 401k, if you get a 401k match. I get a one time annual true up, so at the end of the year I’ll be matched the entire 1% in contributions even though I front loaded it. If you get matched per paycheck, you may miss out on some money and I don’t recommend that.

What’s nice is that even though I’m just a contractor at a tech company, my temp agency, Aquent, provides great benefits. I have healthcare, a 401k, and a small itty-bitty 1% match. (Hey, a match is still a match!) They're awesome if you're trying to get into tech. I’ll happily to refer you if you’re trying to break into tech because they really do take care of you. Just send me an email!

My first paycheck in February, I was getting ~$100 into my direct deposit. Then for the last three (I get paid weekly), my tax withholdings went way up. With my 401k contributions at 75%, I got $0 in my checking account. I emailed HR to ask about that, so we’ll see what’s up 🤨.

Another note: I count my 401k and my 401k match as income even though it's pre-tax because it's still money that I will use to FIRE. My income in my money tracker is a little bit of pre-tax and post-tax AND I don’t count my taxes as an “expense.” I don't know if that's right or not…probably not, but it’s what I do and it works for me. (Leave a comment below if you think I should be doing something else. and why!)

Anyway, so that my income $7061.76 for my paycheck.

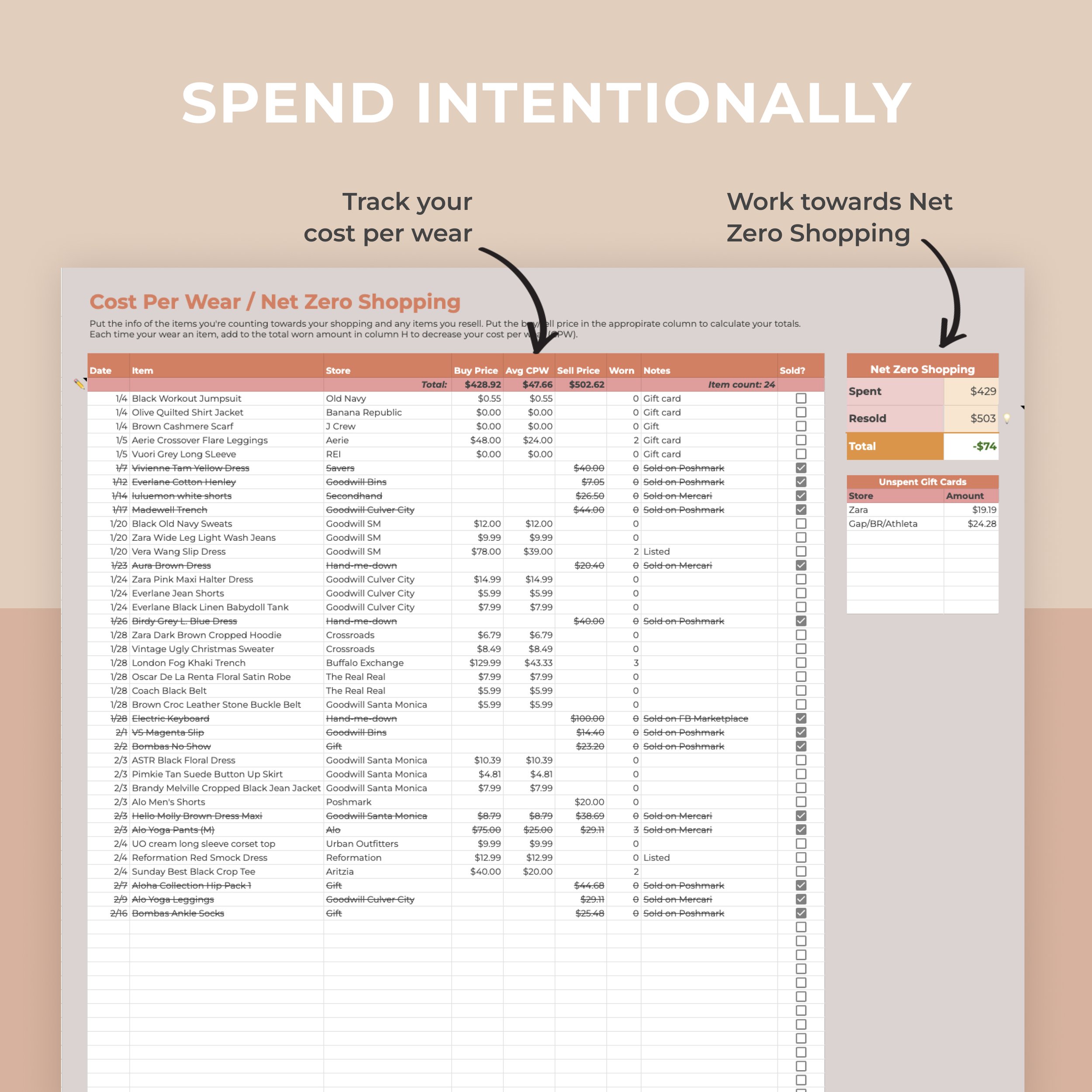

👗 Resale: $0

I didn’t sell anything on Poshmark this month…actually I shipped something, but the direct deposit hasn't hit.

🎨 Freelance: $0

I'm not doing any freelance work in 2021 because it was too stress-inducing last year. I'm just wrapping up one job. It's hard to turn down money when you're trying to pursue financial independence. To be honest, if something comes along that I really can't say no to because they're going to pay me a lot of money, the door is still cracked open for that.

💵 Cash back: $158.49

This money was from my quarterly Rakuten check. (If you don’t have Rakuten, you HAVE TO sign up. Basically it’s free money if you’re already shopping. Here’s my link for a free $20.) Plus somehow I overpaid on my car insurance, so I got a rebate check in the mail. I also have the Citi double cash back card and had $31 from there. Lots of cash back this month.

📈 Interest: $3.81

I keep my 6 month emergency fund in Ally high yield savings account because I like how they have the buckets to compartmentalize your savings even though it's one account. I don't churn high yield savings accounts chasing after the best APY or rewards. It's so much effort and just another form I have to file during tax time. It’s not worth the hassle to me.

🎁 Gifts: $0

🤑 Dividends: $0

🍯 Millennial Money Honey: $19

Those earnings are all from my Etsy shop. It’s baby side hustle money for MMH, but big things are coming in the future! I have some cool collabs in the pipeline.

Expenses

For some context, I know you're probably not new here, but in case you somehow landed on this article and you are, hey, what's up!? Go subscribe to my Youtube channel 🙃. I live at home with my parents. Mom and Dad don’t make me pay rent or utilities. I love and appreciate them SO much! It's been really great and I 💯 recommend living at home if you get along with your parents. Plus we couldn't go anywhere anyway right now, so might as well hang out with fam.

So that being said, yeah, I don't pay anything in housing or utilities.

🏡 Rent: $0

⚡️ Utilities: $0

🚖 Transportation: $16.50

I paid for a lot more parking since I was down in LA this month. I also put Uber type expenses in this category, but there’s been none of that.

🥦 Groceries: $145.54

Again since I was in LA, I've been spending a bit more on groceries. It’s not a crazy amount, but definitely higher than when I’m at home with parents.

🍽 Food: $206.39

I also don’t really spend that kind of money on food at home…not that you’d have any gauge of what is relatively normal 😜 since this is new. Coffee also falls under the food category. I keep my category general because I don't want to be too granular. Eating out is eating out, whether it's coffee or food.

🍹 Drinks: $0

👩💻 Work: $80.18

Hmmm not sure what I spent on that made this category so high. Cloud storage was normal. Bonsai, the best freelancing software, was normal. It puts together contracts, has templates for project proposals, and makes invoice for clients very easy to pay. Bonsai makes me look so professional (read: EXPENSIVE). I highly recommend checking out Bonsai if you're a designer or any type of solo entrepreneur.

Ohhhhh, my b. I forgot about this expense. TubeBuddy, which I talked about in my money diary, What I Spent in a Week in LA, was a big expense. TubeBuddy helps optimize YouTube SEO, write better titles, and figure out what people are searching for on YouTube. I'm hoping it pays off and drives growth to my channel and even this blog.

TubeBuddy was $43.20, making it the majority of my work spending. It typically usually that high. If you have under 1,000 subscribers it’s 50% off instead of the regular $80.40, so check it out TubeBuddy if you’re a small Youtuber interested in growing your channel too.

🍿 Entertainment: $0

✈️ Travel: $0

🚙 Car: $59.19

That's all gas ⛽️. So expensive in California!

🏥 Health: $0

🛍 Shopping: $26.97

I also breakdown this shopping in my money diary, What I Spent in a Week in LA. Although I returned one of the eyeshadows I bought, so there’s a small discrepancy.

💝 Gifts: $39.30

Again check out my money diary from this month. I bought my friend a plant 🪴 and some other stuff as presents. I spend generously on people I love and don't think about it too much. Presents, donating, and meeting up with friends over food/coffee are things I don’t eye too closely.

❓Miscellaneous: $0

Savings

You can see basically all of my money went into savings.

👵 401K: $6,818.12

I will max my 401k out towards the end of March and as a result I did not contribute to anything else.

🏦 Savings: $0

💰IRA: $0

📈 Brokerage: $0

💵 SEP IRA: $0

🏥 HSA: $0

I don't actually have an HSA this year 😭. I don't qualify for one, which really sucks.

💸 Checking: $425

Checking is my income minus the rest of my savings accounts. I don’t have a separate category for that under my savings column in my money tracking spreadsheet.

Monthly Totals

🤑 Income: $7,1243.14

💸Expenses: $574.07

📊 Savings Rate: 92%

My savings rate this year, I'm going to be transparent, will probably be in the 90% range since I’m living at home and my expenses are so low.

I want to give you a true look at my spending, not to brag, but to show you what I’m honestly doing. There are so many other people who are on FI/RE too, I’m just one data point, so don’t let comparison be the thief of joy. You can check out other people’s FI/RE diaries on my blog to read about what other people are doing to achieve FIRE. There are many levels of income, locations and FI/RE numbers!

But being honest, 2021 is going to be a little bit of crazy savings rate for me. It won’t will always be this way. I’m not living at home forever! I'm retiring at 35, so we’ve got another five years to go. This journey is not over yet and I hope you stick around for it!

Let me know if you like this type of content—what I spent in a month series. I love seeing them myself! And if you're on your journey to retire early, leave a comment below and tell me what your savings rate was for February.

Don’t forget to subscribe to my Youtube channel below, it would means so much to me, plus it’s FREE and easy to do.

Let's retire early together!

Disclosure: Some links are affiliate links, meaning, at no additional cost to you, I may earn some compensation. All opinions are 100% my own! I truly appreciate you and your support. :)