September 2019 Savings Rate

/Wow, wow, wow! 77.13%?! 😯 This has gotta be THE MOST I’ve saved in one month. It’s my first month into my F.I.R.E. (Financial Independence, Retire Early) journey, which I think has been a huge motivating factor to get me to save way more than I normally do. 🔥

For reference, my August savings was only at 14.49%—mainly due to starting a new job so had a lapse in paychecks coupled with some big expenses (like $500 on a haircut and color.)

Savings

I have ~$9,000 left to contribute for the rest of the year. I’m only on this contract job, in which I have a 401k, until the end of November, so I’ve upped my contributions to a whopping 29% to max it out in the next 5 paychecks. 😮 I need to be careful to not over contribute since my balance is been split up between my old 401k account.

I also opened an HSA that comes with my HDHP and need to crunch the numbers to see if I can max out this triple tax-advantaged account for 2019.

Here’s my full September savings breakdown:

Savings - Travel: $500.00

Savings - Big Event: $0.00

Brokerage: $1,300.00

Checking: $908.56

401k: $926.10

HSA: $0.00

Roth IRA: $1,600.00

Savings - Emergency: $400.00

Income

The majority of my high savings rate was a result of starting a new job. My new hourly rate right now is at $70/hr plus overtime, up from $41/hr, no OT.

In support of pay transparency and closing the gender wage gap, here’s a breakdown of all my income (gross pay, after taxes)

Paycheck: $6,545.09

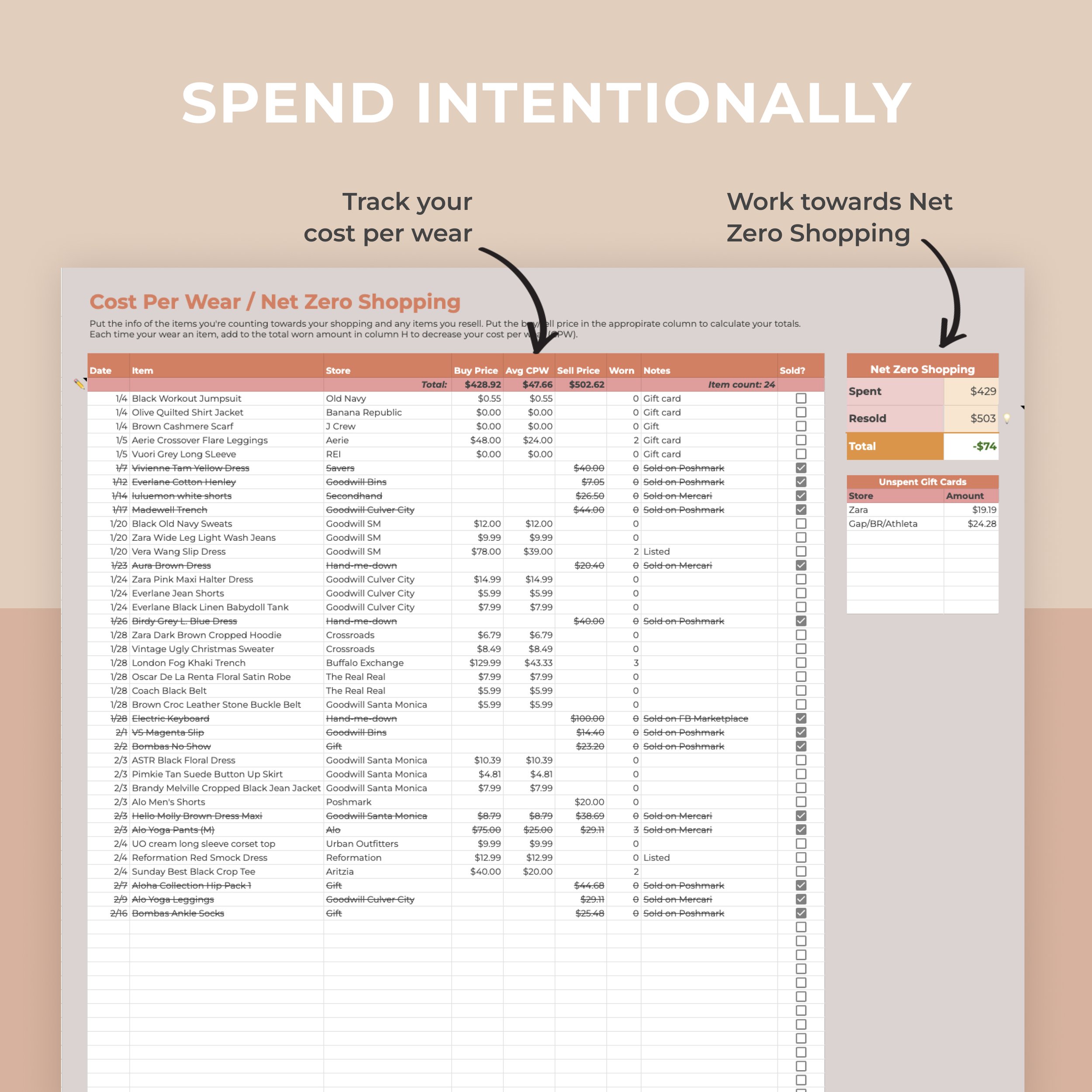

Resale: $43.00

Freelance: $20.00

Cash back: $77.22

Expenses

The majority of my expenses went to housing and utilities (18.59%). But I also spent quite a bit on going out, which is my Drinks category. 🍻 I lump the cost of transportation (Uber/Lyft) into this category too so I can see my true cost of going out.

Right now in my life, socializing is a HUGE priority and something I don’t skimp out on. Saving for retirement 👵 vs. living with my friends in the moment 💃 is a trade-off worth spending on for me.

House: $960.00

Utilities: $283.35

Transportation: $15.56

Groceries: $90.75

Food: $53.29

Drinks: $102.88

Work: $45.00

Entertainment: $8.00

Travel: $93.49

Car: $79.60

Health: $213.00

Misc.: $31.84

October is gonna be a BIG month for me. I turn 28 and have lots of friends whose birthdays are this month too.

According to Wealthfront, which has been monitoring all of my accounts for the last few years, I save more consistently at a 53% rate. Hoping to be about that level when it’s all said and done, even with upping my 401k contributions!

xo, Catie

Disclosure: Some of these links are affiliate links, meaning, at no additional cost to you, I may earn some compensation. All opinions are 100% my own! I truly appreciate you and your support. :)