FI/RE Diaries: A 25 year old mechanical engineer living in the Bay Area and FIRE-ing in 15 years with $2M

/Occupation: Mechanical Engineer

Industry: Medical Devices

Location: Bay Area, CA

Age: 25

Salary: $90k

FI/RE Number: $2M

Years Until FI/RE: 15 years

Current financial situation: SINK

Ethnicity: Asian/Pacific Islander

How did you first hear about FI/RE?

My sister started learning about the concept of FI/RE and got me hooked on the idea. I had just started working full-time and didn’t really know what I was doing with my money. I’m naturally pretty conservative with my spending, but I had everything in a normal savings account and none of it invested. I’ve still got lots to learn, but I’m definitely making smarter choices!

Why do you want to reach Financial Independence/Retire Early?

I like the idea of having financial stability. It makes me feel secure knowing that if anything were to happen to my career, I'd have the money I need to survive without it.

What does FI/RE mean to you?

I'm mostly focused on the FI part. To be honest, I don't see it changing my life completely, but it will give me peace of mind in my financial status. I'll be able to work on my own terms and not feel obligated to stay in situations I don't want to be in because I need the money. I'm also looking forward to taking time off to travel when and where I want without feeling guilty about the expenses!

What types of big expenses does your FI number include?

Traveling! I’ve got a long list of places to explore and I don’t want to feel limited by money.

How much do you spend per month? Save per month?

I spend $1000 - $1500 and save about $2500

What is your % savings rate?

About 70% after taxes

Are you doing anything to achieve FI/RE faster? If yes, what?

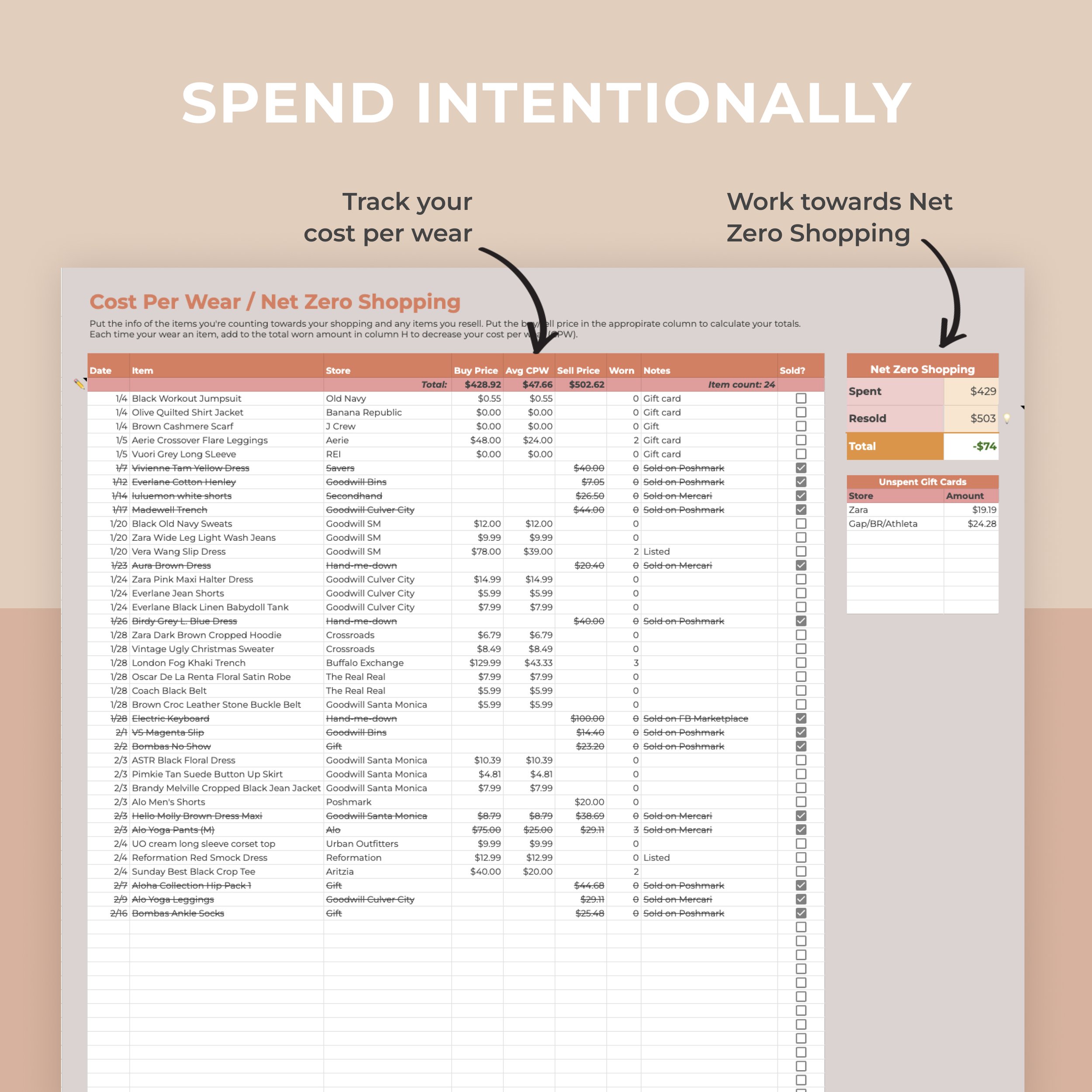

Working on those side hustles and being intentional about my spending.

Any advice you'd give to someone who has a similar FI/RE lifestyle as you, especially if it seemed hard or unattainable?

Consistency is key. You may not see your money grow immediately, but looking back over a couple of years or even months, it's encouraging to see all the progress you've made. And while you're focused on saving for retirement, don't forget to set aside some $$ to treat yo self today.

Disclosure: Some links are affiliate links, meaning, at no additional cost to you, I may earn some compensation. All opinions are 100% my own! I truly appreciate you and your support. :)