How to Retire Early: How Much Money Do You Need to Retire Early?

/Retirement isn't about working until you're 65, it's actually about the dollar amount that you need to have invested to be able to live off that for the rest of your life. This is something that a lot of people don't realize and it’s why I'm so passionate about sharing that this is an option.

We're diving into the last part of my three-part series on how to retire early. If you haven't seen the first parts be sure to go check them out—how to get in the FI/RE mindset and how to find your savings rate & reduce spending. Today we are talking all about how much money you actually need to make and have invested to be able to retire. Let's talk money honey!

How much money do you need to retire early?

The very simplest formula and the one actually I used when I first calculated my number with is:

(Annual expenses x 25) + One-Time Large Expenses

You're probably wondering why 25? That number comes from the 4% rule from the Trinity Study. It was a study of retirees portfolios based on historical stock market data that showed how much money they could withdraw from the retirement portfolio and safely never run out of money. They determined that 4% was a safe withdrawal rate where you could live off your nest egg and never run out of money.

For early retirees, some people play it safe since we have a longer timeline than the average retiree. They use the formula:

(Annual expenses x 33) + One-Time Large Expenses

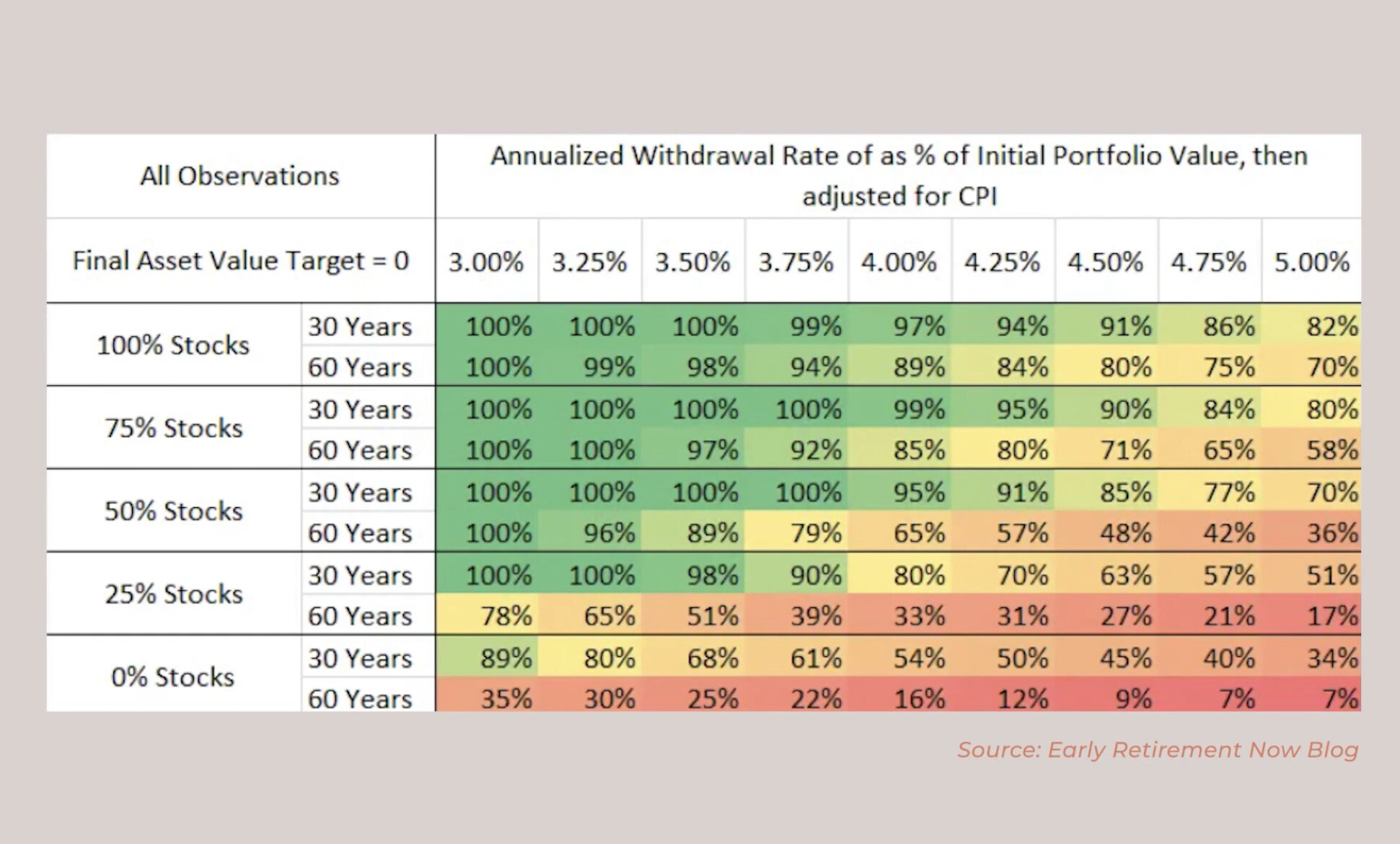

That means you could do a safe withdrawal rate of 3%. Take a look at this chart from the Early Retirement Now blog, which basically visualizes the data from the Trinity Study and explains how they got to the 4% rule.

Source: Early Retirement Now Blog

Okay, I lied! I know I said you would never run out of money, but actually according to this, there is a 1% chance that you would run out of money based on their study. This assumes a 75% stock / 25% in your retirement investments on a 30 year time horizon. The odds though, are definitely in your favor.

This is great news! However, since we're early retirees here, we need to look at more of a 60 year time horizon. If you use the Trinity Study and 4% rule to determine your FI/RE number and safe withdrawal rate (SWR), your portfolio will only be 85-89% successful, assuming you have 75%+ in stocks.

To offset potential failure at a 4% SWR, many early retirees end up pursuing passions that make them a little money—hobbies that don't feel like working. It’s easier to make money doing things that bring you joy, especially when you have so much more time to hone in on your craft.

If you are truly planning on never working again, a 3% SWR might be a better target for you. You can see on the chart that even having as conservative as a 50% stock / 50% bond portfolio, you will still have a 100% chance of success with the 3% safe withdrawal rate.

Once you've calculated that number, you're going to add on any large single one-time expenses. For example, if you want to pay for your kid's college or if you want a really nice wedding, you'd factor that in. Take this example:

(Annual expenses x 25) + One-Time Large Expenses

($50,000 yearly spending * 25) + ($250,000 university tuition * 2 kids) = $1.75 million to retire early

What about inflation?

I always get asked if it accounts for economic inflation, and the answer is yes. Assuming average market returns are at 10%, you're going to subtract inflation. So 10% stock market growth - 3% inflation = 7%. If you're withdrawing at 3-4%, well below that growth, you should theoretically be “safe.”

So yes, this formula does take into consideration average rates of inflation and average market returns, but it does NOT account for lifestyle inflation. It assumes your lifestyle stays about the same. You can’t spend more extravagantly once you retire early and it assumes you will live the life that you are currently living. Unless your portfolio has done so extremely well after many years of living the same that you safely have multi-millions of dollars, then you can go ahead and ball out!

When I retire I don't see myself flying first-class everywhere. It’s not what I value spending on. I definitely prioritize being able to retire early and become financially independent over being able to eat caviar every single day.

My FI/RE number

So let's dive a little bit deeper into what I am actually targeting for my FI/RE number and how I got to the number that I did. I am currently a Single Income No Kids woman or a SINK. That is the acronym commonly used in the FI/RE community. DINK would be Double Income No Kids or DI1K stands for Double Income One Kid. The FI/RE acronyms can get a little bit confusing! SINK does not mean wash your hands sink!

So as a SINK, my current annual expenses are around $30,000 each year. I'm actually currently living at home with my parents, but I based this number off of my lifestyle in Los Angeles after living there for 10 years. However, part of my plans for early retirement is to have kids.

To safely ensure that I am able to have children with or without a partner, I am doubling my annual expenses to $60,000. This way I feel like I have a safety net to be able to take care of them and live well within my means. Since I am targeting a 4% SWR, I multiply $60,000 x 25 to get my FI/RE number of $1.5 million.

Hopefully this amount will allow me to save for my kids education, be able to take care of them on my own, and if I were to have a partner, then potentially our collective FI/RE number might be double that— $3 million. That’s a 4% SWR of $100K/year. FatFIRE DINK GOALS!

I am comfortable withdrawing at a 4% rate because I'm not going to sit around and do nothing all day. I am planning on being a stay-at-home mom and taking care of my kids, but I will continue to pursue hobbies that earn income. I have my Etsy shop and a YouTube channel. Mostly though, I will be able to enjoy time with my kids and side hustle as much (or as little) as I want to. I’d be able to only make money doing things I love.

Adjust accordingly, but don’t keep pushing your goals

Something that's important to keep in mind for your own FI/RE number, is it can always change. In my short time pursuing FI/RE it has changed from $1.25 million to $1.5M because I felt it was a safer number. You should always plan for the unknown. You don't know if your health expenses will end up being really crazy. On the flip side, you shouldn’t keep pushing the goal post back and never reach what you consider financial independence.

So $1.5 million is a safe FIRE number for me at the moment, but always subject to change. It's really important to stay true to yourself and feel what's best for you. It's your life, don't let anybody tell you that that's too little. That's a comment I get a lot from people who are lovingly concerned... Only $1.5 million?! That’s not enough! But my answer to that is yes, it is.

There are many other people before me who have done this. I wouldn’t be a pioneer in the space and be pursuing early retirement if there weren't other people who have written about it and successfully retired early. I see them and I want that life too! I want that for you and for everybody to know that they can retire early and not have to be working until you're 65 , which is what I always thought you had to do.

Final thoughts

To recap all of the how to retire early series be sure to check out the first one on how to get in the right mindset for FI/RE, the second one on tracking your money and learning to cut back your expenses, and the third one, this one, is about finding your FI/RE number.

I hope you found this series helpful. It's so important whether or not you retire early to have the ability to choose whether or not you want to work. This will truly help you enjoy life better knowing that you don't have to work, rather that it's optional.

I'm really excited for you to be on this journey with me and follow along as we go through this adventure to early retirement together! What are your thoughts on the 4% rule and if you've calculated your FI/RE number, be sure to leave that in the comment below! Share when you are retiring early so maybe we can coincide and meet up from margaritas haha!

I hope you enjoyed this series! Be sure to subscribe to Millenial Money Honey on YouTube so we can keep spreading the FI/RE.

Let's retire early together!

Disclosure: Some links are affiliate links, meaning, at no additional cost to you, I may earn some compensation. All opinions are 100% my own! I truly appreciate you and your support. :)